Mission Produce: The Quiet Giant That Transformed the Avocado Industry

Hey folks,

Let me tell you about one of my greatest obsessions: avocados. In fact, I’m so into them that around ten years ago, I started my own avocado farm in southern Italy!

Since the early 2000s, the avocado has gone from niche fruit to global superstar, and it’s no accident. A big part of the story is thanks to the rise of ready-to-eat products and the tireless work of some early adopters. Meet Mission Produce, the California-based powerhouse that’s now one of the global leaders in avocado development and distribution. (there’s another fascinating player in this space, but I’ll save that for a future article.)

So, what makes Mission Produce a game-changer? These guys aren’t just a bunch of farmers with crates of avocados. They’ve mastered the whole process from farm to table with a vertically integrated model. They source avocados globally (including from their own farms in South America), handle distribution, and provide a bunch of value-added services along the way.

Mission Produce went public on the Nasdaq in 2020. (Before you get any wild ideas, this is not financial advice. Seriously, don’t base your investments on what you read here—these are just my personal thoughts!).

How Mission Produce Was Born

Mission Produce’s story kicks off in 1983, thanks to Steve Barnard—a guy who knew his way around a farm long before he started the avocado empire. Growing up as the son of a citrus and avocado grower in California, Steve always had a passion for agriculture. To chase that dream, he enrolled at California Polytechnic State University, where he earned a degree in Agricultural Economics. During his studies, he worked all kinds of jobs in the field, including stints at his father’s farm and even harvesting tomatoes for a canning plant. After graduating, Steve had his eyes set on joining the family business, but there was just one small problem: they only had room for one person, and that spot wasn’t his1. So, he had to find his own path.

Steve found his way to Santa Clara Produce where he eagerly took on any role he could get his hands on. He started out loading trucks but quickly moved up the ranks. Within weeks, he was working in their refrigerated warehouses, earning a modest $125 a week. Not exactly a dream gig, but Steve took it in stride, managing large harvest crews and learning the ropes. When Santa Clara decided to venture into the avocado business—mainly to keep an unused packing house running—they entrusted the responsibility to a veteran manager with decades of experience. This seasoned manager was tasked with overseeing the operations, relying on the support of Steve, who had strong personal connections within the grower community. By 1981, the elderly manager decided to retire, and given Steve’s instrumental role in forging and strengthening grower relationships, he was offered the position to continue driving the avocado business forward.

But it didn’t take long for Steve to see that Santa Clara was missing the boat on avocados. The whole venture was started for the wrong reasons, and the business wasn’t capitalizing on the huge potential of the market. He came up with a plan to turn things around, but the owners shot it down. Steve gave them a heads-up not to be surprised if he started his own thing, and that’s exactly what he did.

Armed with $900,000 in funding and an office inside a trailer, Steve launched Mission Produce in 1983—determined to follow his vision for what the avocado business could really be.

Steve’s Vision: Always Play Offense

At the heart of Mission Produce is its founder and CEO, Steve Barnard, now joined by a new President and COO, John Pawlowski, in 2024. If you catch any of Steve’s interviews2, you’ll quickly see he’s the classic American entrepreneur—building his success from the ground up. His deep knowledge of the agriculture industry didn’t just happen overnight; it’s been earned through decades of hard work, starting in his youth helping out at his father’s farm. He’s done it all—harvesting crops, managing farm teams, running warehouses, and dealing directly with producers.

But what sets Steve apart isn’t just his experience. It’s his raw passion for agriculture. This guy loves farmers—like, genuinely loves spending time with them. It’s no wonder he pursued a degree in Agricultural Economics and went straight into the industry, even when his father told him there wasn’t room for him in the family business. He was willing to take whatever job came his way, as long as it meant learning more. We’ve already covered how his first gig post-college was loading crates at Santa Clara Produce for a mere $125 a week, grinding through 100-hour weeks. But here’s the kicker: Steve doesn’t even think of his work as work. That’s how much he’s into it.

Then there’s his fearless mindset. Steve’s all about taking risks, embracing mistakes, and rolling with the punches. He knows failure happens—it’s part of the game. One first example? Back in the early ’90s, he made a misstep trying to break into the mango market. It didn’t work out, and they eventually had to shut down that line of business.3 Fast-forward to today, though, and Mission Produce is right back in the mango game, stronger than ever. This relentless drive to push forward, take risks, and play offense is what defines Steve. His philosophy is clear: keep evolving, keep moving, and never rest on your laurels.

Relationships are another cornerstone of his success. Steve goes out of his way to stay connected with people across the company, traveling constantly to meet managers and keep the lines of communication open. As of October 2023, Mission Produce has grown to 3,300 employees4, and Steve makes it a point to engage with his team as much as possible.

On top of that, Steve’s learned from the best. He’s had some incredible mentors along the way—one being J.R. Simplot, a legend in agribusiness who worked for over a century and amassed nearly $4 billion in wealth. Steve credits Simplot with inspiring him, particularly when they teamed up in the ’90s to venture into the frozen guacamole business

So, what’s the secret to Steve Barnard’s success? It boils down to this: bet on yourself, don’t fear failure, and get back up every time. Mix that with a deep love for what you do, expert knowledge of your field, and the wisdom gained from surrounding yourself with mentors who push you to grow. That’s Steve’s recipe for staying on top.

The next two paragraphs dive into the avocado market and its supply chain. If you’re already familiar with both, feel free to skip ahead to the section where I break down the inner workings of Mission Produce.

The Avocado Market: More Than Just a Fruit

Avocados (Persea Americana) have a rich, layered history that traces back over 5,000 years to the pre-Columbian civilizations of Central and South America. Indigenous peoples from modern-day Mexico, Guatemala, and other parts of Central America were the first to cultivate and incorporate this nutrient-packed fruit into their diets. The three major avocado varieties—Mexican, Guatemalan, and West Indian—each evolved separately, giving us the remarkable genetic diversity we see today.

The Spread and Historical Development

Avocados started their journey beyond the Americas in the 16th century, thanks to Spanish explorers like Hernán Cortés, who discovered the fruit on expeditions through Mexico. From there, avocados found their way to Europe and later spread to Spanish colonies in the Caribbean, South America, and Southeast Asia. Initially, though, avocados remained a bit of an unknown in Europe, largely due to the difficulty of transporting them over long distances without spoilage.

Fast forward to the 19th century, and the avocado started to gain traction in the U.S., particularly in California and Florida, where the climate was right for cultivation. But the real game-changer came in the early 20th century with the rise of the Hass variety. Today, Hass accounts for over 90% of global avocado production. And it all started with Rudolph Hass, a California postman who in 1926 unknowingly purchased a seedling that would revolutionize the market. The Hass variety, descended from Guatemalan avocado stock, won hearts (and markets) with its buttery flavor, thick and pebbly skin, and slow maturation rate, making it easier to transport and store. Before Hass, other “green-skinned” varieties like Fuerte were more common, but they had their drawbacks—less flavorful, more watery, and more fragile.

Thanks to its superior qualities, the Hass avocado rapidly adapted to international markets. From California and Central/South America, cultivation spread to other regions with tropical and mediterranean climates, including South Africa, Morocco, Israel, Spain, and more recently, southern Italy. The avocado is a highly flexible fruit, taking on different shapes and flavor profiles depending on where it’s grown.

The avocado market is dominated by heavyweights like Mexico, Colombia, and Peru, the latter of which has seen a boom in exports to Europe in recent years. Kenya, Morocco, and South Africa are also rapidly scaling up their avocado exports. Mexico, however, still reigns as the world’s top producer, churning out 2.65 million tons annually5, though its growth rate has slowed compared to emerging players.

Demand Growth and Driving Factors

Avocado demand really took off in the ’90s, driven by growing awareness of its health benefits, along with the rise of ready-to-eat products, smart marketing campaigns, and innovative packaging. In the past, avocados got a bad rap for their high fat and calorie content. During the low-fat diet craze, foods rich in fat, like avocados, were avoided for fear of weight gain and heart problems. But modern research flipped that script, showing avocados are packed with heart-healthy monounsaturated fats that boost good cholesterol (HDL) and lower bad cholesterol (LDL), improving cardiovascular health. And that’s just the beginning. Loaded with potassium, avocados help regulate blood pressure and prevent muscle cramps. They’re also rich in vitamins E and C, powerful antioxidants that fight free radicals and promote glowing skin. The fiber content is a major plus for digestion and helps keep you feeling full longer, making avocados a top choice for anyone mindful of their weight.

On top of that, innovations like ripening rooms and ready-to-eat avocados have made a huge impact on volumes, ensuring perfectly ripe fruit is always available. Packaging innovations—like four-packs for a more impactful presentation compared to loose avocados—have helped boost sales. This has also led to more product variety, including organic avocados and smaller sizes. And let’s not forget the role that effective communication has played in highlighting the health perks of avocados. Companies, like Mission Produce, and U.S.-based avocado associations have been instrumental in spreading the word.

Current Market and Future Outlook

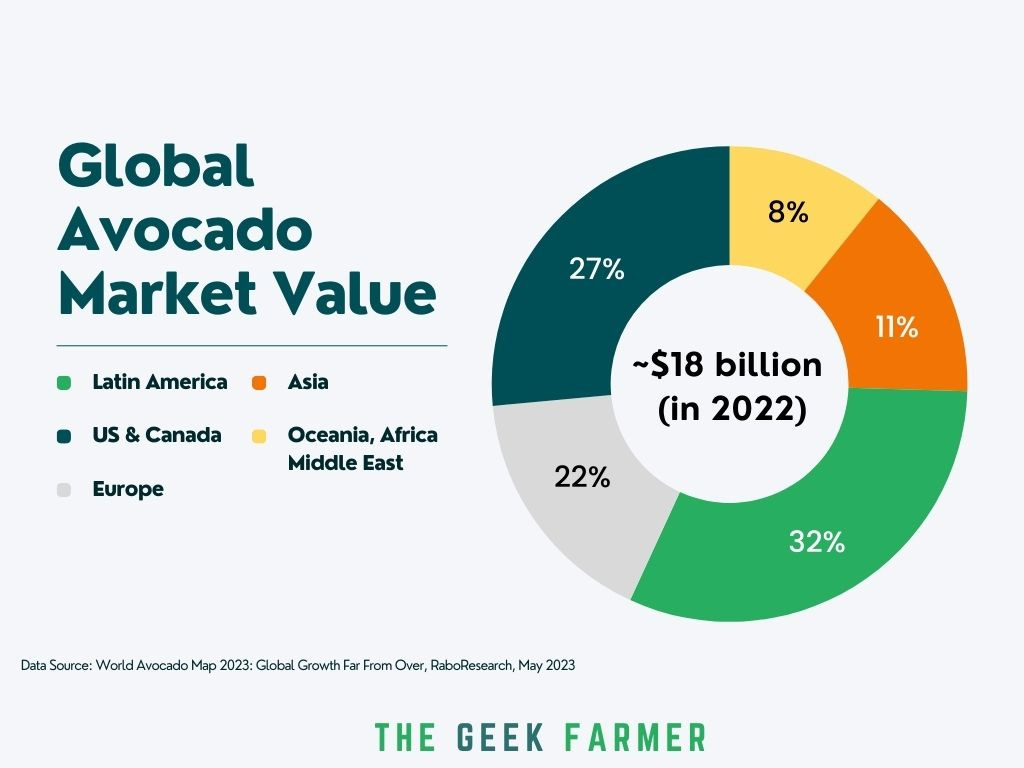

The global avocado market was valued at around USD 18 billion in 2022, with the U.S. and Canada accounting for roughly 27% of the total, followed by Europe for 22%.6

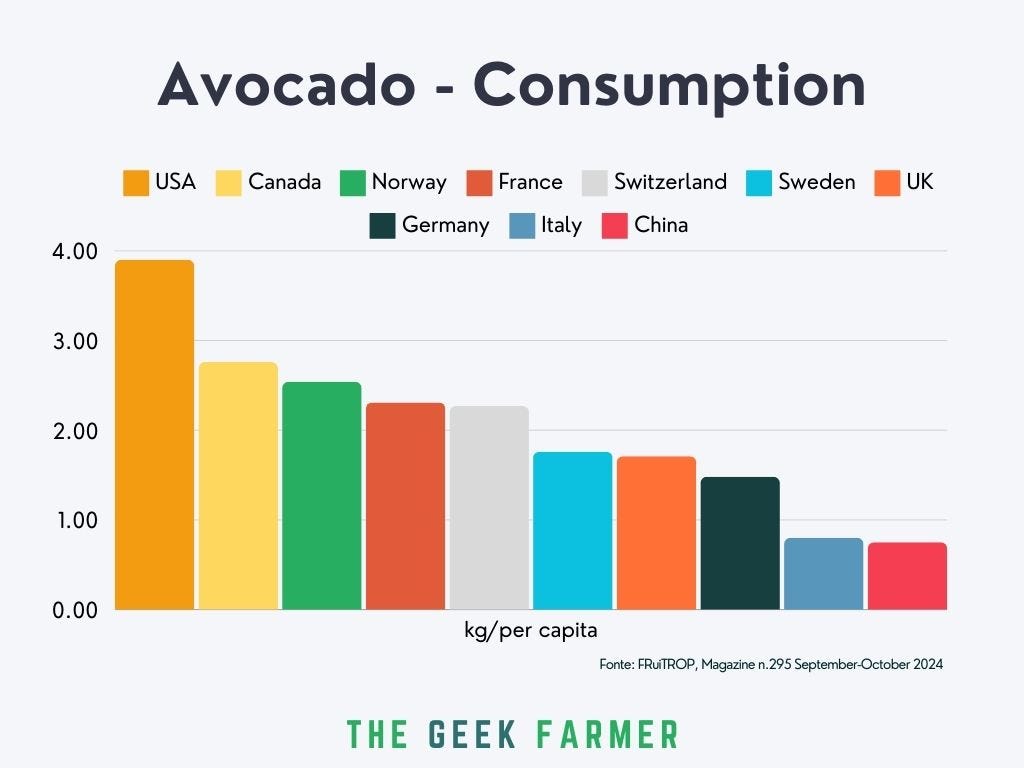

There is substantial potential for growth in various regions, as per capita consumption varies significantly across markets. Mexico leads globally with about 9 kg of avocados per person annually, followed by Chile at almost 8 kg. Australia and the U.S. also have high consumption rates, each exceeding 4 kg per capita.

However, there are stark differences in consumption across Europe. Norway, for instance, leads with the highest per capita consumption at 2.54 kg in 2023, though growth has slowed due to market maturity. Germany, on the other hand, is catching up fast, with around 1.48 kg per capita and rising demand, largely driven by health-conscious promotions. Italy lags behind with 800 grams per capita, but the potential for growth there is substantial.7

Demand for avocados is also surging in other regions, particularly in Asia (China and India), further cementing the avocado’s strong position in the global market.

A Quick Overview of the Avocado Supply Chain

The timing of avocado harvests depends heavily on where they’re grown. In Mediterranean regions like Italy, Spain, and Morocco, the Hass variety is typically harvested between October and April. In Mexico, avocado season runs year-round, with a peak between June and August, while Chile focuses its harvest from September to March.

Avocados are climacteric fruits, meaning they don’t ripen on the tree. They’re harvested once they reach a minimum level of dry matter—essentially, their essential oil content. Early in the season, avocados have lower dry matter, which means they’re of lower quality and take longer to ripen. As the season progresses, the dry matter increases, but so does the speed at which they ripen. Depending on the stage of the harvest, avocados are stored at different temperatures in cold storage, and this varies based on their country of origin.

One interesting aspect of avocado harvesting is that it can be done in stages, starting with the largest fruits. This gives the smaller ones a bit more time to grow, improving their size slightly.

Since avocado trees can grow quite tall, harvesters often use ladders or long poles to pick the fruit. Once harvested, avocados are sent to a processing center where they’re washed, sorted, graded, and packed—usually into boxes that hold about 4 kg of fruit.

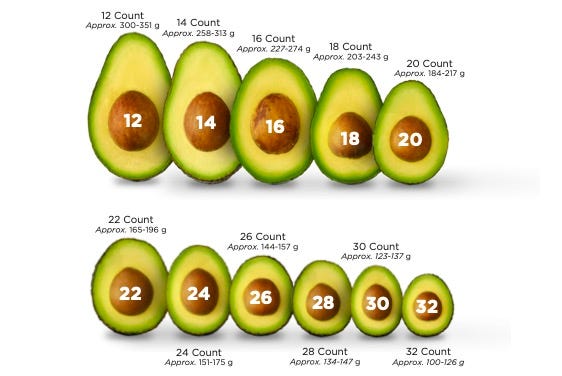

Avocado sizing is determined by how many fruits fit into a standard 4 kg box. For example, a size 20 avocado means 20 avocados fit in a box, so each weighs about 200 grams. The larger the number, the smaller the avocado, and vice versa.

After processing, avocados are placed in cold storage to extend their shelf life. From there, they’re transported—by land, sea, or air—to distribution centers or directly to customer warehouses, depending on the supply chain setup.

Mastering the Supply Chain: Mission Produce’s Organization and Strategy

One of the most compelling aspects of Mission Produce is its full integration across the entire supply chain—from sourcing to distribution, and even offering a range of high-value-added services. This integration has allowed the company to compete on more than just price, driving innovations that have significantly influenced global avocado consumption.

Sourcing

Mission Produce’s primary goal is to ensure a year-round supply of avocados while maintaining the highest quality and most competitive prices. By diversifying its sourcing regions, the company has mitigated the risk of relying too heavily on specific growing areas.

Sourcing from various regions, as we’ve seen, means that for Mission Produce, harvest timing also changes depending on the location. For instance, California’s peak season runs from April to June, similar to Peru. To guarantee continuous supply and offset declining production in California, Mission Produce began sourcing avocados from Central and South America early in its history.

As far back as 1984, Mission Produce established a packing facility in Michoacán, Mexico, to export avocados to Europe and North America. Over time, it expanded operations to Chile, Colombia, and Peru, with Peru now playing a pivotal role in the company’s supply chain. Additionally, the company has now expanded its global presence, with operations extending to the Mediterranean (Morocco and Israel) and Africa (Kenya and South Africa).

Expanding into Mangos

Alongside avocados, Mission Produce has also identified mangos as a high-growth potential commodity. Since 2021, the company has gone “all in” on fresh mangos, leveraging its global network and infrastructure to introduce ripe mangos on an unparalleled scale. By 2023, Mission Produce had sold 46 million pounds of mangos, with plans to expand further.8 Mangos are benefiting from several consumer trends, including the increasing purchasing power of Hispanic and Asian populations in the U.S. and a growing interest in health and wellness, as mangos are rich in vitamins and minerals.

Mission Produce’s expertise in ripening, built over 40 years with avocados, allows it to provide tailor-made mango programs that guarantee ripe, high-quality fruit to customers, further cementing its leadership in the produce industry.

Cutting-Edge Operations and Strategic Growth

Mission Produce’s operations are built around high-tech packing facilities in its key growing regions—Mexico, California, and Peru. The main hub is in Mexico, which, until a few years ago, handled roughly 70% of the company’s avocados. These facilities are equipped with advanced processing lines and high-definition cameras for washing, sorting, packing, and boxing the avocados with precision.

One of Mission Produce’s standout practices is the immediate refrigeration of freshly harvested avocados, a step that eliminates the field heat and extends the fruit’s shelf life by a few days. Once cooled, the avocados are transported to packing centers for cleaning, sorting, and packaging. The less aesthetically perfect fruits are set aside for processing into products like avocado oil. Mission Produce’s cold chain management is among the best in the industry, ensuring top-quality avocados every step of the way.

Strategic Acquisitions

Over the years, Mission Produce has expanded through strategic acquisitions. In the early 2000s, the company acquired a 5% stake in Camposol, a leading Peruvian avocado and produce grower. By 2018, it fully acquired Grupo Arato, a local producer it had already partnered with. These moves were made after building a global sales network that tackled a major issue for producers—finding cost-effective ways to bring their products to market. Owning production facilities gave Mission Produce greater control over supply volumes and quality.

Reducing Risk Through Diversification

Diversifying sourcing regions is critical for Mission Produce, allowing it to avoid over-reliance on any single production zone. As we’ve noted, agriculture is heavily influenced by external factors, especially weather. Avocados are prone to alternate bearing cycles, where high-production years are often followed by lower-yield years. On top of that, events like droughts and frosts can severely impact an entire season’s crop.

To ensure a steady supply, Mission Produce has expanded its presence in Central and South America, as well as overseas, with operations in the Mediterranean (Morocco and Israel), Kenya, and South Africa. As early as 1984, the company established a packing facility in Michoacán, Mexico, to export avocados to Europe and North America. Chile, Colombia, and Peru, the latter now playing a major role in the company’s su chain.

Mission Produce operates mango farms and acts as a grower in its blueberries segment through an exclusive supply agreement with a distributor. This allows them to utilize their existing infrastructure and workforce during complementary periods between avocado harvest and processing seasons, keeping operations running year-round. By 2023, the company managed 3,876 hectares of avocado, 300 hectares of mango, and 560 hectares of blueberries9.

Looking to diversify even further, Mission Produce began directly managing new facilities in Guatemala in 2020 on long-term leased land (1,800 acres), with a different harvest season from Peru. They’ve also partnered with leading local producers in Colombia and entered a joint venture in South Africa to develop avocado farms, collaborating with top local production companies.

Global Distribution and Market Reach

Top-quality avocados from South America are primarily destined for export, especially to Europe, where the longer shipping time (around a month) makes it ideal for expanding avocado consumption in untapped markets. Once packed, the avocados are shipped to Mission Produce’s distribution centers or directly to customer warehouses. The company uses land, sea, and air transportation to get its product to market. Mission Avocado has strategically placed ripening centers in its key markets. In recent years, these centers have expanded beyond the U.S. to Canada, the Netherlands (for European markets), the U.K., and China. These ripening facilities, a game-changing innovation by Mission Produce, have fueled the avocado consumption boom. About 30 years ago, consumers struggled to know when avocados were ready to eat. Supermarkets often sold rock-hard, unripe avocados that took days to soften. Mission Produce flipped the script by introducing ready-to-eat avocados, allowing consumers and food service clients to enjoy perfectly ripe avocados on demand.

In these ripening rooms, avocados undergo pre-ripening using ethylene gas, a natural plant hormone that accelerates the ripening process. The treatment varies depending on the season—early-season avocados with lower dry matter content take longer to ripen than those harvested later. Mission Produce offers its clients five different ripeness stages, providing flexibility to meet diverse market needs.10

Mission Produce also tailors the ripening process to meet the specific needs and requests of its clients.

Mission Avocado primarily serves retailers, wholesalers, and food service companies. By leveraging supply forecasts and avocado availability, the company negotiates fixed-price contracts with its clients for an entire season, insulating them from the price volatility of the spot market.

In addition to custom ripening services based on client specifications, Mission Avocado offers a suite of high-value-added services:

• Logistics Management: Optimizing transport and distribution processes to ensure maximum efficiency and product freshness.

• Promotional and Merchandising Support: Partnering with clients to develop effective marketing strategies and enhance product visibility at retail.

• Custom Packaging: Designing tailored packaging solutions that meet clients’ specific needs, boosting product appeal on the shelf.

• Training on Proper Fruit Handling: Providing clients with specialized training on how to handle and store avocados to ensure the best possible quality for end consumers.

A particularly intriguing aspect of Mission Produce’s approach is category management. In 2023, the company launched AVOIntel, a cutting-edge initiative designed to offer clients valuable insights into the avocado industry. AVOIntel delivers:

• Detailed Reports: In-depth analyses of market trends and avocado sector performance.

• Market Analysis: Studies on supply and demand, consumer behavior, and growth opportunities.

• Best Practices: Sharing proven strategies and success stories to help clients optimize their commercial operations.

• Sales Data: Accurate insights into sales volumes and product performance, empowering clients to make informed decisions.

These additional services not only strengthen relationships with clients but also position Mission Avocado as a strategic partner in the global avocado market, helping its customers grow and succeed.

A Few Numbers Before We Wrap Up

Mission Produce reported revenue of $1.08 billion for the twelve months ending in Q2 2024. This reflects a solid compound annual growth rate (CAGR) of 7.9% in revenue from 2013 to 2023, driven by the rising demand for avocados. During 2023, the company sold 663 million pounds of avocados, achieving a CAGR of 5.3%. 11 This growth has been fueled by the expanding avocado market, particularly in the United States, which remains Mission’s primary market. Revenue fluctuations are largely tied to price volatility, which depends heavily on supply swings.

Over the past decade, Mission Produce has invested more than $500 million in facility expansion and acquisitions. This includes a major facility in Laredo, Texas, to support North American distribution, and a distribution center in the U.K. to accelerate growth in the European market. Investments have also focused on developing plantations in Peru and Guatemala, with the goal of filling seasonal supply gaps.

Looking ahead, the company projects mid-single-digit revenue growth and high-single-digit adjusted EBITDA growth, driven by the increasing global demand for avocados.

So, there you have it—a deep dive into the world of avocados and how Mission Produce is at the forefront of this booming industry. Whether you’re slicing them for toast, mashing them into guac, or just here for the business insights, one thing’s clear: avocados are here to stay.

The next time you’re enjoying that perfectly ripe avo, you might just feel a little closer to the global supply chain behind it :)

If you have any additional insights or spot anything that could be clarified, feel free to reach out! You can drop me a comment or shoot me an email—I’d love to hear from you. See you soon!

https://www.producepedia.com/farmer/steve-barnard

https://www.freshfruitportal.com/news/2021/08/23/steve-barnard-founder-and-ceo-of-mission-produce-we-now-import-more-to-chile-than-we-export/

Mission Produce, Annual Report, 2023

Avocado Annual, Country Mexico, April 2024, United States Department of Agriculture, Foreign Agricultural Service

https://www.rabobank.com/knowledge/q011424941-world-avocado-map-2023-global-growth-far-from-over

Fonte: FRuiTROP, Magazine n.295 September-October 2024

https://www.linkedin.com/pulse/mangos-next-avocado-steve-barnard-ceo-mission-produce-inc--b0vxc/

Mission Produce, Investor Presentation June 2024

AvocaDOs and Don'Ts - MISSION PRODUCE EUROPE B.V.

Mission Produce, Investor Presentation June 2024

Resources Consulted

- Mission Produce Website

- Mission Produce, Investor Presentation June 2024

- Mission Produce, Annual Report 2023

- Mission Produce, Annual Report 2020

- Mission Produce Harvard Business Case 2022 - Forest Reinhardt, Jose B. Alvarez and Natalie Kindred

- Mission Produce, Davis Cracknell, Kendall Moore, Salvador Lopez, California Polytechnic State University, San Luis Obispo, Year 2017